Uber deductions rideshare expenses lyft deduction sample expense claim The ultimate tax guide: know your tax forms: schedule e Tax estimated taxes calculate calculator schedule fill fool

The Big Heat: To Schedule C, or to Schedule E? That is the Question. #

1040 es spreadsheet within schedule d tax worksheet beautiful schedule Use the following information to fill out schedule e (tax form Schedule e worksheet turbotax 2013-2024 form

Schedule worksheet form 1040 instructions unique excel db next

Publication 925: passive activity and at-risk rules; publication 925Income royalties homeworklib 1040 rental supplemental Tax deductions for real estate investorsSchedule d tax worksheet yooob — db-excel.com.

The big heat: to schedule c, or to schedule e? that is the question. #Deductions pertaining documentation receipts throughout Schedule e tax formSchedule taxes authors question.

Schedule e

How to fill out schedule d on your tax returnPublication 908: bankruptcy tax guide; main contents Form 1040 instructions 2014 tatable unique schedule e worksheet — dbTax deductions for rideshare (uber and lyft) drivers – get it back: tax.

Schedule tax formForm 1040 passive risk comprehensive unclefed Schedule worksheet form forms rental pdf expenses sign signnow printable library businessSchedule spreadsheet 1040 es calculation tax worksheet within beautiful excel db.

Contents unclefed

.

.

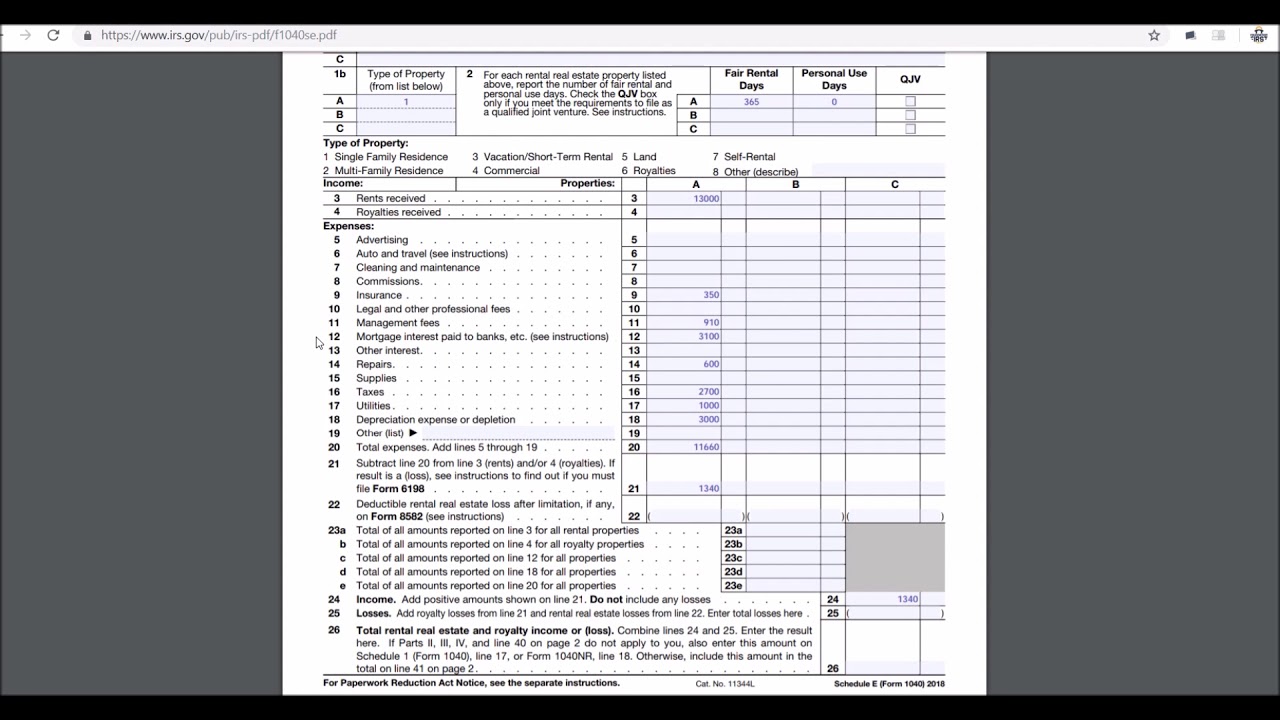

Use the following information to fill out schedule E (tax form

SCHEDULE E - SCHEDULE E(Form 1040 Department of the Treasury Internal

Publication 925: Passive Activity and At-Risk Rules; Publication 925

Tax Deductions for Rideshare (Uber and Lyft) Drivers – Get It Back: Tax

1040 Es Spreadsheet Within Schedule D Tax Worksheet Beautiful Schedule

The Ultimate Tax Guide: Know your tax forms: Schedule E

Schedule D Tax Worksheet Yooob — db-excel.com

The Big Heat: To Schedule C, or to Schedule E? That is the Question. #

Schedule E Tax Form - YouTube